What does the acronym 4PL stand for?

The acronym 4PL stands for “4th Party Logistics” and describes the relationship between the parties to a goods transaction.

For example, if the manufacturer of a product is the first party, its buyer is the second party. If only these two parties are involved in the transaction, either the supplier will deliver the goods or the buyer will collect them. If both parties do not have their own transport capacities, they commission a third party, a so-called freight forwarder or 3PL. This party then takes over the transport of the goods for a fee.

In the case of transport from or to overseas, the supply chain usually consists of the services of numerous individual parties which are hired by a 3PL. The 3PL acts as a reseller, similar to a wholesaler. The aim of a 3PL is to maximise profits with the best possible utilisation of both its own and outsourced services and capacities.

How is a 4PL different?

4PL stands for a strategic approach to logistics and supply chain management. A 4PL company is an independent player that acts as a supply chain manager. This means that it analyses, optimises and coordinates a company’s supply chain by selecting, managing and integrating all required service providers (carriers, 3PLs, freight forwarders, warehouses, customs agents, etc.).

The advantages of the 4PL concept are:

- Increased efficiency leads to significant cost savings in logistics.

- Strategic orientation and risk management from the customer’s perspective instead of maximising own profits.

- Global access to services, transport and storage capacities with strong purchasing power due to grouping effects.

- Flexibility to react to changing market conditions and unforeseen challenges at any time.

- Technological integration f all parties involved in the supply chain.

- Cost transparency and passing on the conditions of all parties directly to the customer.

Prologue Solutions

Working with Prologue Solutions as a proven 4PL offers you not only tangible, but also measurable added value. You benefit from various factors that have a significant and lasting positive impact on your logistics processes and logistics costs, both individually and in combination.

If you would like to know more about our business model as a 4PL and why this could be of interest to you as an importer, please contact us: to our contact form

Flowfox was founded in September 2019 by Patrick Pehmöller and Moritz Dassing. The company is developing a platform to accelerate the processes surrounding container clearance. The company founders describe their approach as follows:

“Our mission is to set new standards for the container shipping industry by enabling shipping companies to automate the import process and allow carriers to obtain their clearance in real time,” Patrick Pehmöller explains.

Flowfox currently employs eight people, is on the verge of the pilot phase, and is conducting advanced negotiations with several shipping companies. The platform is planned to launch this year.

For more information, please visit: www.flowfox.com

Prologue Solutions CEO Patrick Merkel sees enormous potential in partnerships and comments on the motivation to participate in Flowfox as follows:

“Digitalization in logistics, but especially in shipping, lags far behind in comparison to other industries. Manufacturing industry 4.0 is in full bloom, while today’s shipping industry has not experienced a revolution since the container was invented. Shipping industry 2.0 would be an industry with new and revolutionary standards in data exchange and digital workflow automation, similar to the second industrial revolution in the 1930s driven by standardization, unleashing unimagined possibilities. We believe that Flowfox technology will make an important contribution to this overdue development in the shipping industry by allowing shipping companies to set new standards and automate their business over the last mile in a revolutionary way.”

Hello Patrick. Could you start by giving us some insight into your professional life? What do you have on your desk this week that is particularly on your mind or affecting you?

My central focus at the moment is mainly Prologue Solutions GmbH in Hamburg. That is why my family and I moved to Germany in 2019, after nearly 12 years in Hong Kong. What has kept us occupied the most at Prologue since 2016 has been everything to do with digitalization. We started some concrete projects as early as 2018 that have now gradually been implemented since summer 2020. This is as much about our internal processes as it is about partnering with customers, business partners, and service providers throughout the world. We are already able to offer our partners a high degree of digitalization and process automation.

Global transport logistics is currently experiencing massive disruptions, especially of course due to the global coronavirus pandemic. In which area do you currently see the most severe impacts?

The effects of the pandemic are currently preoccupying people and businesses alike. There is virtually no area where there are no restrictions or obvious effects. In industry, trade, and logistics, the first weaknesses were revealed when China went into lockdown and production across the country came to a virtual standstill. China is still the world’s workbench, and suddenly supply chains were being demolished. Other countries in Asia were also affected. Later, the exact opposite happened when the virus arrived in Europe and America. Fueled by the immense demand for products to protect against the virus, demand rose to unprecedented levels and overburdened the available production and transportation capacities. Massive price increases and severely delayed delivery and transport times are consequences felt today yet and place a heavy burden on the economy here in Germany as well.

How are you responding to the current challenges at Prologue?

As a fourth-party logistics provider (4PL), Prologue plays an overarching role in our customers’ supply chains; crisis management is also one of our tasks. One of the central pillars of our business model is partnering with transport carriers, i.e. shipping companies, for instance. Prologue works with long-term contracts in which all our customers’ volumes are pooled. This puts our customers and us in a situation similar to industrial or trading companies with their own large freight volumes. So the price increases on the spot market are not a real problem for us. The greatest difficulty is the out-of-balance distribution of containers among shipping companies. Empty containers do not arrive in time at our customers’ suppliers, which sometimes leads to considerable delays. At the same time, in the United States, the container ships are jammed in the ports which, due to the great volume, are falling behind with the unloading and onward transport. Our teams in Hong Kong and Hamburg are currently working day and night together with our business partners’ regional offices and local carriers to minimize these impacts on our customers. Our booking platform, which we have been rolling out step-by-step since 2018 for all ports and carriers worldwide and are continuing to develop together with the French supplier, is of central importance. Without the constant overview of the daily booking situation, we would have sunk into chaos long ago.

How has the coronavirus pandemic changed the supply chain management of individual companies?

While the biggest problem for large companies is the delivery time component and the lack of predictability, the price increase is hitting mid-sized exporters and importers equally hard. Up to 1,000% price increases in freight rates on the spot market mean that transport costs are making products much more expensive or it no longer makes any sense to transport goods. I know many companies that have had to cancel orders as the transport costs would have led to high economic losses. Fortunately, the big players are currently refraining from applying contractual penalties. It is not yet clear what lessons individual companies will learn from this time of crisis and who will actually survive the crisis, much less emerge from it stronger.

In turbulent times such as these, there is a lot of talk about the importance of resilient supply chains. What is meant by the term resilience, and how can I make my supply chains more resilient?

A supply chain is resilient when it is crisis-proof. Crisis-proof means that a supply chain functions reliably even when it is exposed to significant external influences. Therefore, resilient supply chains are an impossibility. However, each company can ensure that its supply chain consists of as many dynamic components as possible and that they are as controllable as possible so that external influences can be effectively countered. The decisive factor is, therefore, the selection of suppliers and service partners. However, that only works in times of crisis if there is full transparency and functioning communication, ultimately ensuring the flow and processing of information. Only then will the processes remain controllable. Even the last defender must have noticed that this does not work with Excel spreadsheets and emails, or even messenger systems. Modern supply chain management systems or even better corresponding platforms are not only ideally suited for this, but, in my opinion, there is no alternative to them for successful supply chain management in the future.

The entire logistics world is currently experiencing a huge boost in digitalization. From your point of view, what are the biggest challenges and the most important trends?

The industry has a lot of catching up to do when it comes to digitalization. The race to catch the industry up in terms of digitalization started 2–3 years ago, also driven by the disruptive business models of numerous startups. However, the ultimate deciding factor is what the end customers, i.e. the importers’ and exporters’ customers, really want and are prepared to pay for. The failed RFID revolution a few years ago emphatically demonstrated that technology alone is not yet able to have a far-reaching influence on business models. In my opinion, the same will happen with blockchain. The fact of the matter is that digitalizing or even automating bad business processes ultimately results in bad digital or automated business processes. The technology is ready for groundbreaking change, but are the key players’ business models ready?

In a few days, it will once again be Chinese New Year. Why is this such an important date for the logistics world?

For the Chinese, Chinese New Year (the first new moon between January 21 and February 21) is the most important time of year. Chinese New Year, or CNY for short, is traditionally celebrated with the whole family. Officially, there are six public holidays, but offices and factories are usually closed for several weeks. During this time alone, up to 400 million people who work in the cities as migrant workers travel back to their home provinces. In 2019, the Chinese government registered more than 2.9 billion travel movements during this period. Therefore, it is crucial to place orders with Chinese producers in good time so that deliveries can be shipped before the CNY holidays begin. This is especially important for the retail trade, which has to ship its goods for the spring season at this time. Year after year, this leads to a massive increase in freight traffic in the period between Christmas and Chinese New Year.

Thank you for the interview!

Disposable income in 2020 continued to increase.

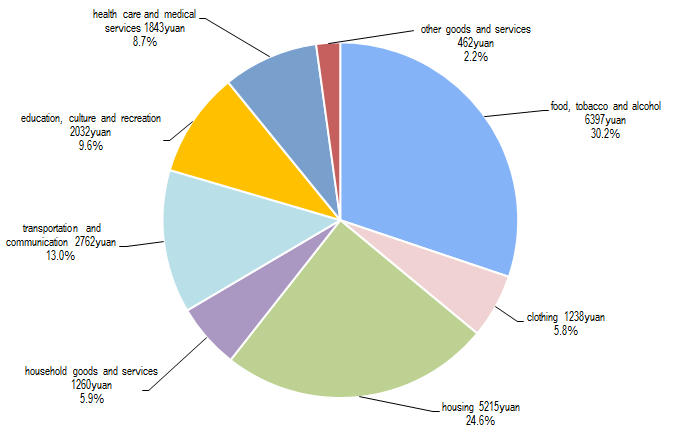

The National Bureau of Statistics of China published new economic data a few days ago. The population’s per capita disposable income increased by 4.7% in 2020 compared to the previous year and by 2.1% in price-adjusted terms to 32,187 yuan (approximately 4,100 euros) per capita (average, about 1.4 billion people).

The highest increase in expenditure was 5.1% (relative to the full year) in the food, tobacco, and alcohol consumption category, which accounts for 30.2% of the per capita disposable income (6,397 yuan, approximately 815 euros). Expenditure on housing and furnishings also increased by 3.2%.

Spending on clothing fell by 7.5%. Household goods fell by 1.7% and transport and traffic by 3.5%. Education, culture, and entertainment fell by 19.1%, and spending on health fell by 3.1%.

Chinese retail figures

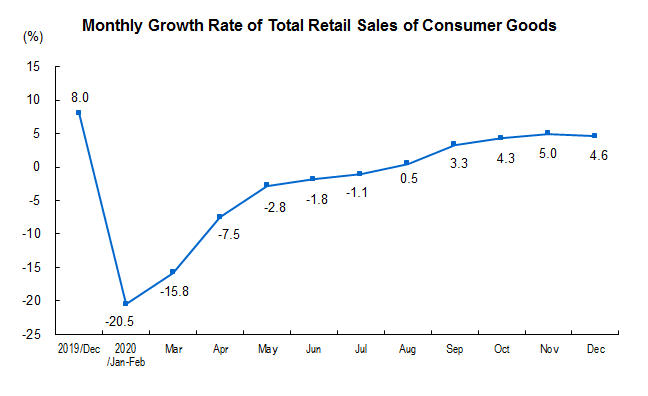

Retail sales increased by 4.6% in December compared to the previous year (or by 4.4% excluding automobile sales), but growth for the full year 2020 is not yet back to the previous year’s level.

December 2020:

Total retail sales (excluding e-commerce) and including automobiles: 4,056.6 billion yuan (516.6 billion euros according to the current exchange rate), 3,569 billion yuan (454.5 billion euros) excluding automobiles. 3,569 billion yuan is 4.4% higher than the comparable previous year’s figure.

Full year 2020:

Total retail sales (excluding e-commerce) and including automobiles: 39,198 billion yuan (4,991.7 billion euros), 35,256 billion yuan (4,489.7 billion euros) excluding automobiles. 35,256 billion yuan is 4.1% below the previous year’s figure. Brick-and-mortar business once again started increasing since February 2020 but could not catch up to the previous year’s growth.

Online retail (e-commerce) increased by 10.9% year-on-year to 11,760.1 billion yuan (approximately 1,495 billion euros) in the same period.

Durable consumer goods, including electronic products in online retail, increased by 14.8%. Nondurable consumer goods such as food, beverages, medical devices, cosmetics, etc., increased by 30.6%, and the clothing/footwear category also experienced 5.8% online growth.

The share of e-commerce in total retail sales is thus about 25% and increasing.

Development depending on the format

Cumulatively from January to December 2020, supermarkets increased overall by 3.1% compared to the previous year, while formats such as department stores (–9.8%), specialist stores (–5.4%), and branded stores (–1.4%) continued to experience losses compared to the previous year. However, the losses were smaller than those up to the end of September 2020.

National economy

According to preliminary calculations by the National Bureau of Statistics of China, gross national product (GNP) was up 6.5% in the fourth quarter and up 2.3% cumulatively.

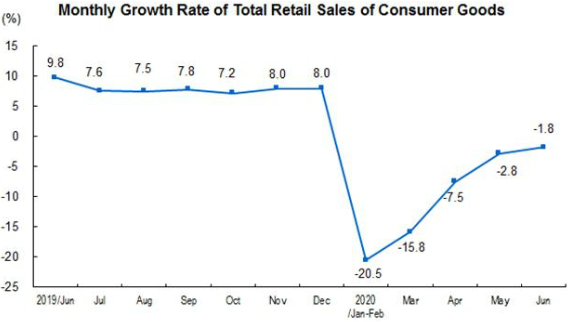

June 2020

Total retail sales (excluding e-commerce) and including automobiles: 3,352 billion yuan (406.6 billion euros according to the current exchange rate), 2,991.4 trillion yuan (362.88 billion euros) excluding automobiles. 3,352 billion yuan (406.6 billion euros) is 1.8% lower than the comparable previous year’s figure and 2.9% lower in price-adjusted terms.

January – June 2020

Total retail sales (excluding e-commerce) and including automobiles: 17,225.6 billion yuan (2,089 billion euros), 15,586.9 billion yuan (1,890.25 billion euros) excluding automobiles. 17,225.6 billion yuan (2,088 billion euros) is 11.4% lower than the previous year.

Online retail (e-commerce) increased by 7.3% year-on-year to 5,150 billion yuan (approximately 624.7 billion euros) in the same period and now accounts for 25.2% of total retail volume.

Durable consumer goods, including electronic products, increased by 38%. Nondurable consumer goods such as food, beverages, medical devices, cosmetics, etc., increased by 17.3%, and only textile products experienced negative growth at –2.9%.

Retail in urban and rural areas

Since more than half of Chinese live in cities, it is not surprising that the corresponding retail volume in June was 2,905.2 billion yuan (352.39 billion euros) and was down 2% compared to the previous year. In rural areas, the retail volume decreased by 1.2% compared to the previous year, reaching 447.4 billion yuan (54.3 billion euros).

Development depending on the format

Cumulatively from January to June 2020, supermarkets increased overall by 3.8% compared to the previous year, while formats such as department stores (–23.6%), specialist stores (–14.1%), and branded stores (–14.4%) lost by double digits compared to the previous year.

National economy

The gross national product (GNP) in the second quarter was up 3.2% compared to the previous year and was, cumulatively for the 1st and 2nd quarters, still down 1.6% compared to the previous year.

As a result, the Chinese economy has visibly recovered from the coronavirus faster than the rest of the world.

These figures are based on the press release from the National Bureau of Statistics of China on July 17, 2020, and the exchange rate as of August 7, 2020.

Is our positioning in education, innovation, reliability, quality, and infrastructure good enough to lastingly withstand international competition? China is vehemently occupying a former domain of Germany: the standardization organizations. This is a clear sign of increasing competition. Whoever sets the standards prevails. The country has already overtaken us in terms of internet infrastructure, as well as in railway technology, chip and computer construction, plus many areas of household and consumer electronics. The sheer dimension of Chinese infrastructure, ports, rail links, airports, schools, universities, etc., sets them apart. The next domain in which China is taking a swipe at us is mechanical engineering.

Dependence on China due to the coronavirus pandemic

The coronavirus crisis provides a second argument for curbing globalization. At the beginning of the crisis, there were not enough face masks and face shields in Germany, as well as other medical items such as gloves or protective clothing, as such products are no longer produced in Germany due to unit cost disadvantages. This dependency on other national economies, especially the Chinese economy, which alone had enough capacity and know-how to gradually eliminate the bottlenecks, is loudly criticized.

It is obvious that the German government and economy have neglected the obligation to provide and ensure civil protection. Since there has been no such pandemic since the Spanish flu a hundred years ago, everyone in a position of power was unaware of the risk. That also applies to the private sector. It is doubtful that anyone in Germany stocked up on face masks or toilet paper before the coronavirus hit.

After the crisis is before the crisis. Armed with this knowledge and the corresponding measures, it should be possible to correct too high a risk tolerance in globalization and shift critical production, e.g., for active ingredients in medications, to uncritical locations. However, the example of the much-needed protective masks during the pandemic shows that this is probably easier said than done.

China wants to play a leading role

A third argument that is not linked to the trade war or the coronavirus is becoming more and more widespread in the media. China is increasingly portrayed as a country that wants to dominate the world – as a state-capitalist one-party system that lacks any democratic legitimacy. Huawei, the Hong Kong Security Law, and Internet censorship are listed to paint the threats to the Western world.

At a time when the United States of America with their ‘America First’ can no longer (strive to) fulfill their original role as a force for order and Europe as a whole cannot speak with one voice, China is filling the vacuum and taking the initiative. Moreover, Chinese science and business can now take the lead in certain key areas. The government strategy and financial resources to do so exist.

Is the right response to this development to erect more trade barriers? The government there will not listen to warnings from Europe. Economic sanctions are ineffective. Europe, and Germany in particular, cannot afford trade restrictions with China. That is why Chancellor Angela Merkel’s dealings with Chinese government officials must be described as extremely prudent. The measures taken to make it more difficult to transfer technology and know-how in the event of company takeovers are more effective and do not call into question the fundamental economic cooperation.

Xenophobia versus globalization?

Another event to strike at the very core of Europe is the influx of migrants from Afghanistan, the Middle East, and Africa: Does society want to integrate migrants, or is sealing them off the better strategy? The burgeoning xenophobia in many countries is also used as an argument against globalization.

However, the issue of how to deal with migration has nothing to do with the issue of globalization. And vice versa: abandoning globalization will not stop the flow of migrants. The cost of a humanitarian solution to migration, on the other hand, can only be financed if Europe and Germany continue to be able to make savings in the global competition between economic areas.

What is the answer to the question of whether globalization has a future?

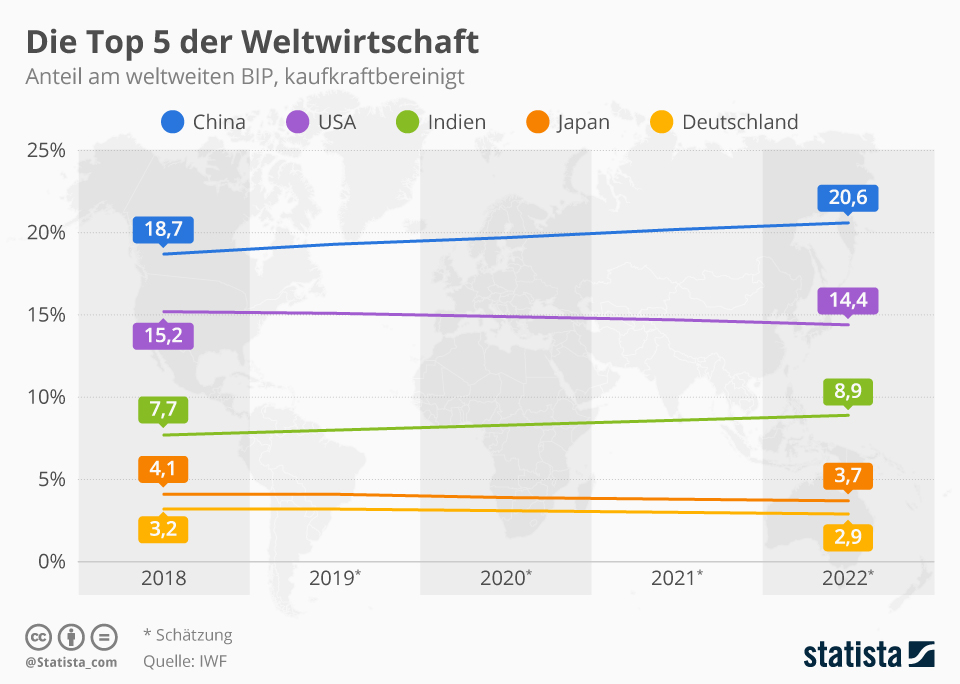

The debate about whether or not China has the right political system will get us nowhere. China has proven that it can feed its population (1.4 billion people) and has brought prosperity to the majority of the population. Moreover, it has undertaken structural reform from an agricultural to an industrialized state. Its national economy has fought its way to the top of the world’s largest economies – and it is still rising.

The future and opportunity to secure our prosperity through coexistence lies only in our competing regimes and cultures. That is not possible without globalization.

In order to secure their position in the world, Europe and Germany must become more efficient and faster. Only that can help companies compete globally.

How can Europe and Germany become more efficient and faster?

The democratic structures in Europe and Germany must adapt. Democracy is synonymous with pluralism and reflects a diversity of opinions. However, this precious achievement is coming under increasing pressure as democratic decisions take a lot of time to prepare, and majority decisions are increasingly not accepted by any stakeholder group. By involving more authorities and courts, the implementation of important decisions is becoming increasingly slow, even though they should actually be made under great time pressure. The struggle of EU countries to reach compromises, such as on the EU coronavirus aid package, is a clear example of this.

Another example is the discussion on refugee admission quotas in EU member states. The much-hyped unity at the end of such decision-making processes fits into our value system, but not into global competition, where the participants operate at different speeds.

More speed and investments

In 1949, Germany opted for a broad federalist structure when redesigning its government. This decision can certainly be seen in the context of the history of Germany since Napoleon, including the history of the Holy Roman Empire of the German Nation. In the age of global economic and political structures, federalism in its present form should be put to the test. What has already been said for the EU also applies to this democratically federal structure: Majority decisions are normally not accepted by the opposition at any level; therefore, it takes a very long time to prepare policies. Plus, their implementation fails or is delayed due to stakeholders’ objections. A good example here is the course of the coronavirus crisis. Initially, the Chancellor was able to implement a clear package of measures to deal with the crisis; however, two weeks later, the states were divided about the adequacy of the measures. Moreover, there are countless examples of large-scale projects that have been implemented with great delays or have failed due to the complexity of the decision-making structures. The “Digitalization in the Education System” project alone illustrates this, especially since the coronavirus crisis revealed the actual situation. A comparison with Asian countries shows exactly where we stand. We are too slow.

We are talking about billions in public funds, which should now finally provide relief in many cases (digitalization in health care, education, public administration, transport and traffic, security, fiber optics as an infrastructure measure, hydrogen technology for climate protection, research funding, etc.) as a package of measures. Obviously, the crisis was needed to convince the various groups of stakeholders that there is a considerable need for action. Also because of the coronavirus, but above all due to our position in the global market.

We need more speed and timely investments in key areas in order to maintain our unique position as a successful national economy internationally.

Even after the Second World War, groundbreaking technological developments, such as the containerization of shipping, aircraft construction, communications technology, cellular technology, or operational software solutions for all commercial and technical processes, have caused the world to shrink. This development was accompanied by huge infrastructure investments all over the world with the expansion of ports, airports, roads, railways, telecommunications networks, the internet, etc. All this was the prerequisite for globalization as we know it today. Everything from the increasingly free-flowing exchange of goods to the work of institutions such as the WTO (World Trade Organisation), the international standardization organizations such as DIN and ISO, but also the increasing interdependence of supranational institutions and mergers in economic areas, and, last but not least, almost unlimited tourism are part of the phenomenon that is globalization.

Why does globalization exist?

Since the beginning of industrialization, the economy has followed the lowest price of resources, and thus the lowest unit costs to maximize profits, like a law of nature. For a long time, low wages in China, India, Vietnam, or South America were not called into question. Prosperity for all those involved increased incessantly in this win-win situation. Consumers in the Western world benefited from low prices for their consumption of products, such as from China. The average wealth advantage over the lifetime of a consumer, through savings in the form of low unit production costs in low-wage countries, is probably in the hundreds of thousands of euros per consumer.

Using self-researched calculation examples, Die Welt showed in its 05/15/2020 issue that the price advantage for a pair of women’s tights from China as opposed to a pair produced in Germany is reflected in the consumer’s purse with an advantage of 13.78 euros. In the case of Sennheiser headphones, the price advantage for the German consumer is as much as 401 euros per set.

China’s path to becoming the leading exporting country

In 1976, at the end of the Mao Zedong era, China was still economically on the precipice. No one thought of it as a low-wage country yet. More people are believed to have died in the Great Chinese Famine for which Mao Zedong bears the greatest responsibility than in World War I (“Tombstone” by Jung Chang).

When he came to power in 1978, Deng Xiaoping had to face a huge challenge: How could a famine of this magnitude be overcome for a population of more than 1 billion people while creating jobs and at least modest prosperity? The special economic zones along the coasts, where more than 600 million people already lived at that time, laid the foundations for today’s prosperity through industrial settlements.

The one-party political system with structures similar to the former communist Soviet Union is now a successful state capitalist country with currency reserves of about USD 3 trillion. Citizens enjoy freedom in the acquisition of property, choice of occupation, choice of place of study, establishment, travel, etc. With the exception of a brief interruption under Mao Zedong, the competitive academic examination (Gaokao) held in July each year has existed since the 3rd century AD (Han Dynasty) and has become a cultural trademark for all of China. Industriousness, ambition, and the desire for prosperity are the motivation for development. Since the period under Deng Xiaoping, China has built itself up in a way like no other place in the world. However, the Chinese one-party system’s handling of freedom of the press, censorship, freedom of expression, freedom of assembly, personal rights in criminal proceedings, etc., has drawn criticism.

To return to the example of women’s tights, STATISTA reports that in Germany in 2020, (total) tights sales are expected to reach about 1.2 billion euros. Hypothetically, if all tights were imported from China and cost 10 euros, as calculated by WELT, then the 1.2 billion euros in sales revenue correspond to a production volume of about 120 million pairs of tights.

In this hypothetical example, the price advantage for the German consumer would be around 1.65 billion euros – if all tights were always manufactured in China. But China makes more than just tights; it also makes shoes, underwear, clothing, household goods, 60% of the world market demand for computer chips, mobile phones, pharmaceuticals, active ingredients, etc. It is probably easier to say what is not made in China.

Germany currently imports around 110 billion euros of goods from China. So what are the annual savings for our consumers? 150 billion to 250 billion per year? Entire industries, especially trade with hundreds of thousands of workers, operate with these savings – or can only exist because these savings exist. The consumer has also learned that a pair of women’s tights costs 10 euros, not 23.78 euros.

High production level in China

The exporting country initially benefits from producing commodities domestically and employing the working population in factories. Especially in China, it was observed how quickly the country learned and went from simple production facilities to highly qualified manufacturing. Moreover, Western business partners were generous with their technology, which they ceded to China as know-how in the build-up phase. Meanwhile, China has long since left that initial phase behind. The level of technical equipment in today’s factories is much better than the level that the German footwear and textile industry, for example, had at the time of the exodus from Germany. The companies produce at a level that we have never achieved at this stage in Germany. As wages rise in Europe, jobs have increasingly shifted to China, India, Vietnam, etc. That applies to all industries. In the meantime, there have even been relocations from China to other countries because China also wants to secure the unit cost advantages of lower wages in other countries. China created tax incentives for domestic industry to that end.

While simple jobs moved abroad, Germany specialized, realizing unit cost advantages from this specialization and the associated division of labor. Employment shifted from wage-intensive to specialized enterprises, made possible by the existing education system and infrastructure. Germany, in particular, benefited from the unit cost advantages thus gained and invested in higher-quality production (automation and automation technology), climate protection, and innovation. At the same time, China’s bad environmental record is part and parcel of German consumers’ savings. For decades, the price advantages of imported products came at the expense of the environment and the prosperity of the citizens in China, India, or Vietnam. At the same time, we also exported our development and social costs to China. Our exports of goods to China amounted to 96 billion euros in 2019.

Germany exported goods and services throughout the world in 2019 in the value of around 1,328 billion euros. Imports amounted to 1,105 billion euros, which means that the surplus is 223 billion euros. That means that, as a ‘small’ economy, Germany plays a clearly unique role in the competition, which will hopefully remain the case for us. Our prosperity is heavily dependent on this positioning in the world market. Only China had a higher trade surplus than Germany in 2019 at 421.9 billion (USD). Russia ranked third with a surplus of around USD 165 billion.

The incentive for China and others to buy goods and services from Germany lies in the innovation, reliability, and quality of the products and services. Without the reciprocal incentives (price, innovation, reliability, quality), there would be no international exchange of goods!

Globalization is becoming ‘slowbalization’

The course of the US-China trade war provides an initial argument. A national economy with no advantages over other countries (price, innovation, reliability, quality) wants to implement tariff barriers to protect the local economy. In 2019, the 20 largest trade deficits totaled USD 1.8 trillion. The countries with the largest deficits are known to include the United States (USD –922 billion), the United Kingdom (USD –223 billion), and India (USD –160 billion). By contrast, the top 20 countries running surplusses have a total surplus of about USD 1.6 trillion. What happens if the other countries with trade deficits follow in the U.S.’s footsteps and implement trade barriers? Since the BREXIT decision, the UK has been trying to strike individual trade deals with the world.

Does that mean this is the end of globalization? How things go will depend on the wisdom of the politicians who are members of the World Trade Organisation (WTO). It is doubtful that de-globalization would work. Can the economic pressure to reduce unit costs put an end to innovation, reliability, and quality? Hardly. A study by the BMWi (German Federal Ministry for Economic Affairs and Energy) that examined and evaluated the economic facets of globalization in detail (including the development of direct investments) also came to this conclusion. The report assumes globalization will continue, but at a much slower pace (slow-balization).

You can read what this means for Germany in the second part of the article.

The world gross national product (GDP) amounted to USD 84.84 trillion in 2018. European countries (including the UK) contributed 22.62 trillion. The U.S. contribution was 20.9 trillion, and China’s contribution was 14.2 trillion. Statistically, China has the highest purchasing power parity (PPP) at USD 27.4 trillion. According to the World Bank’s database, the United States has a GDP PPP of 21.4 trillion; for comparison purposes, the German national economy has a PPP of 4.5 trillion. European countries expect high single-digit contractions in GDP due to the coronavirus crisis – China estimates a contraction of only 2%.

Simply put, gross national product is an aggregation of investment (private investment and government spending), consumption, and export surplus (or deficit).

- According to a report by The Balance, in the United States, consumption is close to 70%, investment (private and public) is around 35%, and the export surplus is –5%.

- According to Index Mundi, in China, consumption is approximately 39%, investment (mostly public) is around 59%, and the export surplus is +2%. The government contributes a great deal to growth through its infrastructure investments. Therefore, consumption still has great potential.

- No general overview is available for the EU countries. For the Federal Republic of Germany, consumption in 2018 was about 54%, investment was about 39%, and the export surplus was approximately +7%.

Retail sales in China

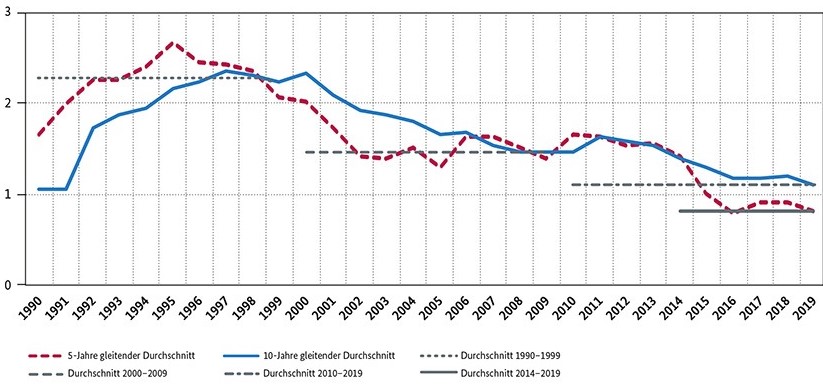

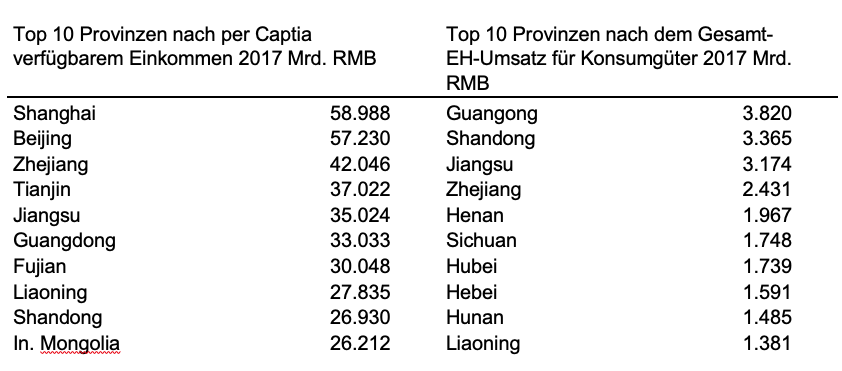

Um die Betroffenheit der chinesischen Wirtschaft durch Corona besser analysieren zu können, ist ein kurzer Blick auf die Einzelhandelsvolumina nach Provinzen hilfreich:

As is well known, Wuhan, which was completely affected by the lockdown, is located in the province of Hubei (a total of about 58 million residents). In the top 10 provinces by retail sales, Hubei ranked 7th in 2017. In the two years 2018 and 2019, trade there grew by about 8%. Accordingly, the retail volume in this province in 2019 was about 230 billion euros – about 30% of Germany’s retail volume (including gas stations and pharmacies). The total retail volume in China is of the order of 5.5 trillion euros, which is more than the gross national product in Germany.

The fact that the total drop in sales in the January/February period throughout China was ‘only’ about 20% can be explained by the fact that, on the one hand, the strict lockdown only applied to the province of Hubei. There was no general lockdown of retail stores and restaurants in the other provinces but a general travel ban, mask requirement, and distancing rules. Moreover, many shops closed voluntarily.On the other hand, a host of circumstances stabilized the situation.Of course, that 20% is an average value. The sale of food and health products increased, while fashion sales fell by 34.2% compared to January/February 2018 (Statista). As already reported last week, the experts estimate the gross national product for the full year decreased by 2%, which probably still means growth. According to official statistics, retail sales in April were only 7.5% below the previous year’s figure (April). Industrial production increased by 3.9% year-on-year – in March, industrial production decreased by 1.1% compared to the previous year.

Traditional retail formats, such as department stores, shopping malls, outlet centers, convenience stores (including) discounters, hypermarkets, supermarkets, and health stores, experienced double-digit growth in January/February with respect to food and health products, while all other product categories decreased significantly (see fashion).

Sales growth in China is already expected to exceed 4% in May. Traditionally, the week after May 1 is one of the highest sales weeks of the whole year. The restaurant business, which was forced to accept high losses due to the distancing rules, also benefited from this.

Sales in the months of January/February and March 2020 increased by more than 20% year-on-year in all categories, especially food. The share of e-commerce already amounted to 20.7% of the total retail volume in 2019. According to its own data, JD.com reported a 215% increase in January/February 2020 for fresh food alone. E-commerce was a stabilizing force during the pandemic. On February 26, 2020, the General Office of the Ministry of Commerce (MOFCOM) published its “Notice of the Typical Measures Ensuring the Supply of Daily Necessities for COVID-19 Prevention.” In it, all retailers were encouraged to organize contactless on-demand delivery. In a matter of hours, delivery stations were established in the residential district. As a result, stationary retail formats intensified their online marketing efforts even more. For everyone, live streaming became the hope of the moment (Alibaba Live, JD Live).

Alibaba with Tao Xiapu and JD.com expanded substantially once again during the crisis with their on-demand platforms. The mini-programs within WeChat became even more popular. Starting on February 19, 2020, some 60,000 small trading companies in all regions started using Wanda Plaza’s WeChat mini-program for their ordering and delivery services. There are and have been no comparable initiatives in Germany. Alibaba and JD.com launched an online retail platform in 2017 with mom-and-pop stores, enabling them to take online orders and deliver them locally in their neighborhoods with the help of delivery companies. Moreover, the retailer has access to online marketing tools. So, theoretically, any dealer can also operate at least two channels in the neighborhood.

Hong Kong particularly hard hit

Among the provinces, the Hong Kong Special Administrative Region (SAR) has seen the greatest reduction in retail sales. Retail sales in October 2019 were already severely affected by the political unrest in the region, with a 24% decrease in sales on account of the lack of tourists and the reluctance of the local population to buy, as they were avoiding Hong Kong Island and Kowloon due to the demonstrations and intermittent riots on the weekends. With the outbreak of the pandemic, the government implemented distancing rules, strict quarantine for suspected cases and commuters to and from the mainland, as well as a ban on meeting in groups of more than four people, etc. Since February, only Hong Kong citizens have been allowed to enter the Special Administrative Region. As a result, retail sales have plummeted by 44%. The e-commerce infrastructure in Hong Kong is not as developed as in mainland China due to its short geographical distances.

It seems that China has so far overcome the pandemic better economically than Western countries. The high penetration of the Internet in all areas of life (trade, schools, entertainment, coronavirus monitoring) has had a stabilizing effect. The measures in Jilin province, where there are still restrictions, as well as the government order on May 12 requiring all citizens in Wuhan to be tested, show that the crisis has not yet been completely overcome.

Even before the end of the Chinese New Year on February 5, interpersonal contact was prohibited in the other provinces. Retail stores and restaurants also closed out of fear of contagion.

After the end of the holidays on February 5 (comparable to the Christmas holiday season in Europe), the schools remained closed, migrant workers were not allowed to return to their jobs, and the opening of most shops (except pharmacies and food markets) was restricted. People in the big cities were urged not to leave their homes. More than 800 million people live in cities and metropolitan areas in China. Chongqing alone has 37 million inhabitants. The population density in China is dramatically higher than in Europe.

A good starting point for crisis management

Trade and the population reacted very well to this situation after the holidays. Even before the crisis, the conditions in China were completely different from those in Europe. That, plus their experience with SARS (2002/2003) affected their management of the crisis.

- Asians are used to wearing face masks or shields to protect themselves and others from colds. People immediately started wearing masks as usual. Initial panic buying focused on masks, hygiene products, and paper towels.

- After SARS (2002/2003), fever clinics were set up throughout the country to serve as contact points for the ill. This relieved the strain on regular clinics (although there were, of course, glaring bottlenecks that even required the construction of two hospitals in Wuhan).

- Measuring fevers and taking temperatures have been part of public life since SARS. Every restaurant, every retailer uses a small electronic device to take its customers’ forehead temperature upon entrance.

- More than 1 billion people use smartphones – and even if we don’t like to hear it, China’s internet infrastructure is better than Germany’s.

- People in China communicate privately via WeChat, the Chinese equivalent of WhatsApp. WeChat is also a commercial platform and has been used for payment processes for years!

- The share of e-commerce in China is significantly higher than in Germany (15–18% of retail sales). Accordingly, they have an army of delivery companies that must also be considered “systemically relevant.” Distribution and delivery are extremely efficient, with more than 90% of delivery companies using e-bikes. Customers are used to using home delivery options.

With these conditions, neighborhood retailers were also able to continue to serve their customers. Order and payment via WeChat, delivery via delivery company – just no longer to peoples’ front doors, but only to the residential district’s delivery zone.

Live streaming as a crisis medium

All retailers understood that their contact with customers must not be interrupted during the crisis! Livestreaming became the medium of the crisis overnight and was especially pushed by Taobao Live, which saw a 719% increase in retailers using livestreaming for the first time in February alone. IKEA started livestreaming on March 10 and had several tens of thousands of visitors within minutes.

Delivery zones were set up at record speed at the entrance areas to the residential districts where customers could pick up their orders. As a general rule, their body temperature was also measured at the same time.

Alipay (the largest Chinese payment service that has the data for more than 1 billion customers in its database and can easily link the data without involving third parties) released a nationwide coronavirus app at the beginning of February that allows every user to monitor his or her own health as well as the situation in their neighborhood.

Traffic light logic (green, yellow, red) is used to evaluate the health status of each user of the Alipay coronavirus app. It also shows the app users what is happening in their environment so that they can avoid hotspots.

All, of course, under (voluntary) renunciation of data protection as understood in the German model and in cooperation with all institutions. In return, users with a green status are allowed to move about unrestricted. The pandemic is revealing the different mentalities of people in the East and the West on an unprecedented scale. The need to protect oneself and the willingness to take responsibility cannot be reduced to the question of the political system!

Contactless becomes a necessity

China experienced a boom in the use of new technologies (robotics, drones, self-driving vehicles, etc.). Suddenly, contactless was no longer an economic issue but a necessity. We have also seen a similar development in Germany, resulting in cashless payments, digitalized processes, and an increase in e-commerce. Suddenly we are even used to masks in public.

The lockdown started to be gradually lifted on March 26 and, in just a few days, all the major malls were back to business as usual. It was once again possible to bring home deliveries to the door. However, it took several months for customers to return to their typical behavior. After SARS, it took about five months until the circumstances and sales returned to ‘normal.’ There is also a certain probability that customers will simply retain certain practices, especially in Germany.

No one wants to take the risk of forecasting the specific economic damage at this time. Some experts predict the gross national product of China will decrease by at least 2%. Trade, tourism, and exports are the three main affected areas. CNBC reports a 3.5% increase in Chinese exports in April but a 14.2% year-on-year decrease in Chinese imports, highlighting the expected economic impact in Europe.

I hope our everyday life gets easier with no increase in new infections.