Online and on-demand: Stabilizing effect on trade in China

Last week, former Karstadt CEO Helmut Merkel wrote an op-ed piece for us about a number of circumstances that stabilized the situation in China during the coronavirus crisis. This week, he analyzes for us the economic dimensions of the Corona crisis and what it means in figures for the retail sector on the basis of well-founded figures.

The world gross national product (GDP) amounted to USD 84.84 trillion in 2018. European countries (including the UK) contributed 22.62 trillion. The U.S. contribution was 20.9 trillion, and China’s contribution was 14.2 trillion. Statistically, China has the highest purchasing power parity (PPP) at USD 27.4 trillion. According to the World Bank’s database, the United States has a GDP PPP of 21.4 trillion; for comparison purposes, the German national economy has a PPP of 4.5 trillion. European countries expect high single-digit contractions in GDP due to the coronavirus crisis – China estimates a contraction of only 2%.

Simply put, gross national product is an aggregation of investment (private investment and government spending), consumption, and export surplus (or deficit).

- According to a report by The Balance, in the United States, consumption is close to 70%, investment (private and public) is around 35%, and the export surplus is –5%.

- According to Index Mundi, in China, consumption is approximately 39%, investment (mostly public) is around 59%, and the export surplus is +2%. The government contributes a great deal to growth through its infrastructure investments. Therefore, consumption still has great potential.

- No general overview is available for the EU countries. For the Federal Republic of Germany, consumption in 2018 was about 54%, investment was about 39%, and the export surplus was approximately +7%.

Retail sales in China

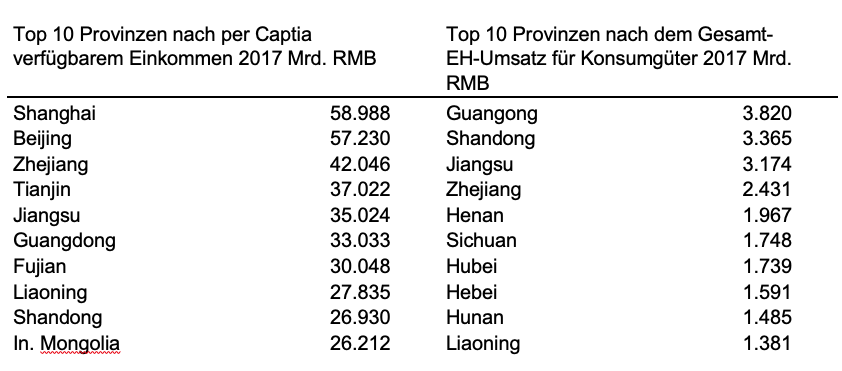

Um die Betroffenheit der chinesischen Wirtschaft durch Corona besser analysieren zu können, ist ein kurzer Blick auf die Einzelhandelsvolumina nach Provinzen hilfreich:

As is well known, Wuhan, which was completely affected by the lockdown, is located in the province of Hubei (a total of about 58 million residents). In the top 10 provinces by retail sales, Hubei ranked 7th in 2017. In the two years 2018 and 2019, trade there grew by about 8%. Accordingly, the retail volume in this province in 2019 was about 230 billion euros – about 30% of Germany’s retail volume (including gas stations and pharmacies). The total retail volume in China is of the order of 5.5 trillion euros, which is more than the gross national product in Germany.

The fact that the total drop in sales in the January/February period throughout China was ‘only’ about 20% can be explained by the fact that, on the one hand, the strict lockdown only applied to the province of Hubei. There was no general lockdown of retail stores and restaurants in the other provinces but a general travel ban, mask requirement, and distancing rules. Moreover, many shops closed voluntarily.On the other hand, a host of circumstances stabilized the situation.Of course, that 20% is an average value. The sale of food and health products increased, while fashion sales fell by 34.2% compared to January/February 2018 (Statista). As already reported last week, the experts estimate the gross national product for the full year decreased by 2%, which probably still means growth. According to official statistics, retail sales in April were only 7.5% below the previous year’s figure (April). Industrial production increased by 3.9% year-on-year – in March, industrial production decreased by 1.1% compared to the previous year.

Traditional retail formats, such as department stores, shopping malls, outlet centers, convenience stores (including) discounters, hypermarkets, supermarkets, and health stores, experienced double-digit growth in January/February with respect to food and health products, while all other product categories decreased significantly (see fashion).

Sales growth in China is already expected to exceed 4% in May. Traditionally, the week after May 1 is one of the highest sales weeks of the whole year. The restaurant business, which was forced to accept high losses due to the distancing rules, also benefited from this.

Sales in the months of January/February and March 2020 increased by more than 20% year-on-year in all categories, especially food. The share of e-commerce already amounted to 20.7% of the total retail volume in 2019. According to its own data, JD.com reported a 215% increase in January/February 2020 for fresh food alone. E-commerce was a stabilizing force during the pandemic. On February 26, 2020, the General Office of the Ministry of Commerce (MOFCOM) published its “Notice of the Typical Measures Ensuring the Supply of Daily Necessities for COVID-19 Prevention.” In it, all retailers were encouraged to organize contactless on-demand delivery. In a matter of hours, delivery stations were established in the residential district. As a result, stationary retail formats intensified their online marketing efforts even more. For everyone, live streaming became the hope of the moment (Alibaba Live, JD Live).

Alibaba with Tao Xiapu and JD.com expanded substantially once again during the crisis with their on-demand platforms. The mini-programs within WeChat became even more popular. Starting on February 19, 2020, some 60,000 small trading companies in all regions started using Wanda Plaza’s WeChat mini-program for their ordering and delivery services. There are and have been no comparable initiatives in Germany. Alibaba and JD.com launched an online retail platform in 2017 with mom-and-pop stores, enabling them to take online orders and deliver them locally in their neighborhoods with the help of delivery companies. Moreover, the retailer has access to online marketing tools. So, theoretically, any dealer can also operate at least two channels in the neighborhood.

Hong Kong particularly hard hit

Among the provinces, the Hong Kong Special Administrative Region (SAR) has seen the greatest reduction in retail sales. Retail sales in October 2019 were already severely affected by the political unrest in the region, with a 24% decrease in sales on account of the lack of tourists and the reluctance of the local population to buy, as they were avoiding Hong Kong Island and Kowloon due to the demonstrations and intermittent riots on the weekends. With the outbreak of the pandemic, the government implemented distancing rules, strict quarantine for suspected cases and commuters to and from the mainland, as well as a ban on meeting in groups of more than four people, etc. Since February, only Hong Kong citizens have been allowed to enter the Special Administrative Region. As a result, retail sales have plummeted by 44%. The e-commerce infrastructure in Hong Kong is not as developed as in mainland China due to its short geographical distances.

It seems that China has so far overcome the pandemic better economically than Western countries. The high penetration of the Internet in all areas of life (trade, schools, entertainment, coronavirus monitoring) has had a stabilizing effect. The measures in Jilin province, where there are still restrictions, as well as the government order on May 12 requiring all citizens in Wuhan to be tested, show that the crisis has not yet been completely overcome.